Condiments

Soya Sauce

Overview

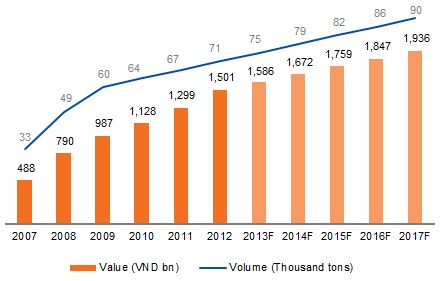

Due to the popularity of fish sauce, soya sauce is still a relatively small market in Vietnam, however, it is undergoing rapid growth. In 2013, Vietnam’s soya sauce market is forecasted to grow 5.7% by retail value and 5.3% by retail volume to reach approximately VND1,586 billion. The market is shifting from unknown brands towards well-known and premium brands, in part due to improved buying power.

In 2007, the market was hit by the discovery of cancer-causing 3-MCPD, found in many low- and mid-tier products. Masan’s Chin-su and Tam Thai Tu were two of only three major soya sauce brands that met the government’s safety requirement, and were able to capitalize on the opportunity to gain significant market share.

Soya sauce market sales and volume data (2007-2017F)

Growth Drivers

The growth of the soya sauce market is expected to continue to be supported by the following factors:

- Increasing demand - Demand for branded soya sauce products is also expected to rise as consumers shift from unknown brands to well-known premium brands.

- Increasing market penetration - Per capita, Vietnam consumes significantly less soya sauce than other Asian countries.

- Improved distribution - Growth of retail channels such as hypermarkets, supermarkets, convenience stores, and independent small grocers in rural areas is expected to improve the distribution of soya sauce and increase customer reach.

Competition

The past several years has seen consolidation in Vietnam’s soya sauce industry. Currently, the top players in the soya market is Masan Consumer, Nam Duong and Nestle.