Drinking tea has become a cultural practice in people’s lives, with a variety of products being consumed such as packaged tea, fruit tea, and milk tea.

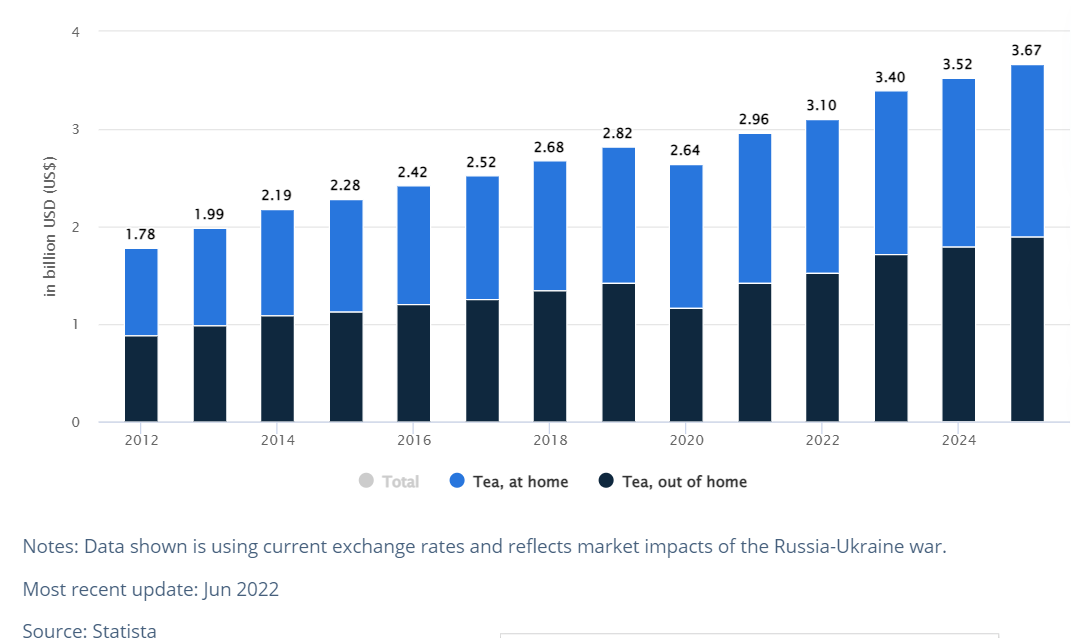

Tea market is valued at US$3.1 billion

Vietnam's tea market is valued at US$3.1 billion in 2022 and is expected to reach approximate $3.7 billion by 2025, according to Statista statistics.

A separate report on the milk tea market by Momentum Works and qlub showed that Vietnam is the third largest milk tea consuming market in Southeast Asia, with a scale of $362 million.

Milk tea is inherently an easy product to copy while Vietnam is a price-sensitive market.

However, a research by Momentum Works emphasized that price is not the only factor influencing customers' decision to buy a drink.

Instead, that choice depends on the types of products offered in stores and the brand coverage.

Established in 1968, Phuc Long is a tea and coffee brand that is popular with young people and distinguished by drinks that combine bold and typical flavors with a trend-leading brewing method.

May 2021 was a turning point for Phuc Long when conglomerate Masan Group spent $15 million buying a 20-percent stake in the F&B chain.

After purchasing more shares in 2022, Masan took control of Phuc Long with a majority stake of 85 percent.

From a beverage brand that is considered a specialty only found in Ho Chi Minh City, after just over a year of becoming a member of Masan, the F&B chain has been present in 27 provinces and cities across Vietnam.

Under Masan’s management, Phuc Long has expanded its system from 72 stores in January to 860 points of sale by the end of September in a diversity of models such as flagship stores, mini shops, and kiosks inside WIN and WinMart+ stores.

Phuc Long kiosks inside the first 27 WIN stores saw a 116-percent increase in revenue a day compared to those at WinMart+ stores, showing significant resonance in the WINLife ecosystem.

Masan expects that Phuc Long will not only contribute to revenue growth by cross-selling through the in-store customer experience and the loyalty customer care platform, but also become a driving force attracting young customers to its retail chain.

In January-September, Phuc Long achieved VND1.14 trillion ($48.35 million) in revenue and VND199 billion ($8.44 million) in earnings before interest, taxes, depreciation and amortization (EBITDA).

Impressive contributors to Phuc Long’s revenue and profit were flagship stores, which earned VND761 billion ($32.28 million) in revenue and VND233 billion ($9.88 million) in EBITDA during the nine-month period, equal to nearly 67 percent of the chain’s total revenue, demonstrating the potential to become a growth engine.

The profit margin of Phuc Long’s flagship stores was even the highest in the world, outperforming that of the Starbucks chain.

In the domestic market, the revenue from a Phuc Long flagship store was estimated to be two to three times higher than that of other F&B brands.

It is expected that Masan will continue to open 30 new flagship stores in the fourth quarter of 2022 to increase revenue and profit.

In addition, in the coming time, Masan Group’s leaders will focus on improving the operational efficiency of kiosks inside WIN stores and researching and developing mini-store models in areas with high demand for drink takeouts.

Online channel contributing 35 percent of revenue

The large scale of points of sale is an advantage for Phuc Long to compete on the online channel in the race to catch up with new consumer trends in Vietnam.

With the strategy of comprehensive growth, Phuc Long consolidates its leading position in the market in terms of the scale of offline selling points while accelerating the development of the online channel.

The integration with Masan helps Phuc Long increase the coverage of packaged tea and coffee products through Win and WinMart+ channels, while Phuc Long flagship stores and kiosks allows the F&B chain to shorten the delivery time of milk tea, fruit tea, and ready-to-drink coffee to customers.

Currently, the revenue from the online channel, including delivery applications such as Grab, ShopeeFood, and Baemin, is contributing 35 percent to Phuc Long’s total revenue as a large proportion of the chain’s customers are young people living in urban areas and proficient in using digital services.

According to a survey, Gen Z, who were born between 1997 and 2012, and Millenials account for 25 percent of Vietnam’s population.

These are also the generations with the highest demand for products and services of the F&B industry and willing to pay high prices for convenient experiences and personal preferences and tastes.